and when, where and how to multiply your pips. Well, what Jim will show you is how to be really profitable at it: how and when to get into a trade. You think you know how to trend trade already? The template setup for MT4 will help you see potential trades more clearly than ever before. Squeeze them for all the juice you can get. To use them to find those million dollar moves and That you've never seen before and show you how Jim will give you new indicators and templates

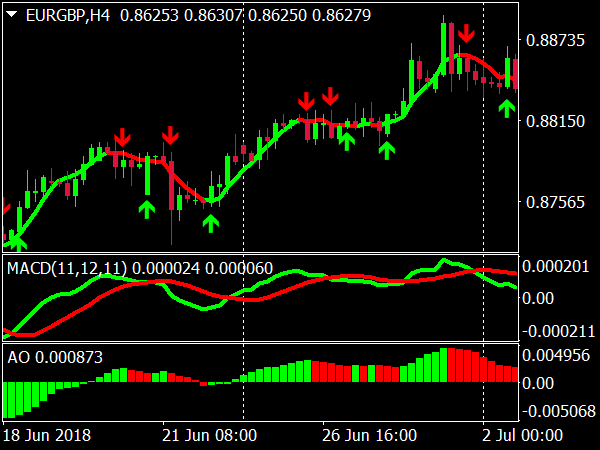

The computer 'spots' the 'potential' trades, There are 'conservative' and 'aggressive' modes. And he does this day after day after day. This is because his indicators include the arrows that sound an alarm to buy or sell.and he can be anywhere in the house and get to his pc in time to open or close the trade.īut the real reason he made so many pips in one day (more than most traders make in a whole month!) is because of his money management method. And the great thing is that he didn't spend much of this time in front of his pc, in fact hardly any time at all, just enough to initiate the trade and close it later. Would you believe that his manual trading system made 667 pips in 11 hours of trading? It's true, I was online with him when he first showed me his trades back in March and we counted the number of pips. I know this to be true because he's been kind enough to spend a few hours with me online via skype and he helped me set up my MT4 platform with his template and indicators and has walked me through his trading day. Not only that, he has a money management system that really pulls the pips for you. Well, with some extra indicators and moving averages and some practice with Jim's strategy, you would have the courage to jump right in. See where the blue up arrow is telling you to jump in long? How many of you would really have the courage to do that? Here's a picture of a typical retracement trade: But actually having the confidence to jump right into a trade on a pullback is a gutsy thing to do.and if you've tried to trade that way, you know what I'm saying is true. The data showed that over the past 5-years, the indicator that performed the best on its own was the Ichimoku Kinko Hyo indicator.Trading retracements is not a new form of trading.there are lots of trading strategies and eBooks that teach how to trade retracements. This is just for illustrative purposes only! Moving on, here are the results of our backtest: Strategy This means if we initially had a long position when the indicator told us to sell, we would cover and establish a new short position.Īlso, we were assuming we were well capitalized (as suggested in our Leverage lesson) and started with a hypothetical balance of $100,000.Īside from the actual profit and loss of each strategy, we included total pips gained/lost and the max drawdown.Īgain, let us just remind you that we DO NOT SUGGEST trading forex without any stop losses. We simply cover and switch position once a new signal appears. We are trading 1 lot (that’s 100,000 units) at a time with no set stop losses or take profit points. Using these parameters, we tested each of the technical indicators on its own on the daily time frame of EUR/USD over the past 5 years. Cover and go short when conversion line crosses below base line Cover and go short when RSI crosses below 70Ĭover and go long when the conversion line crosses above baseline. Cover and go short when Stoch % crosses below 80.Ĭover and go long when RSI crosses above 30. Cover and go short when the daily closing price crosses below ParSAR.Ĭover and go long when Stoch % crosses above 20. Cover and go short when MACD1 crosses below MACD2.Ĭover and go long when the daily closing price crosses above ParSAR. Cover and go short when the daily closing price crosses above the upper band.Ĭover and go long when MACD1 (fast) crosses above MACD2 (slow). IndicatorĬover and go long when the daily closing price crosses below the lower band. For now, just take a look at the parameters we used for our backtest. You’ll learn more about this in your future studies.

0 kommentar(er)

0 kommentar(er)